BNP Paribas, Casino Group and Crédit Mutuel Alliance Fédérale have signed an exclusivity agreement providing for the acquisition by BNP Paribas of all outstanding shares in FLOA, one of France’s leading providers of innovative payments and a subsidiary of Casino and Crédit Mutuel Alliance Fédérale (through Banque Fédérative du Crédit Mutuel – BFCM), for a total consideration of €258 million1, for an equity of €184 million as of end-2020, and a strategic and commercial partnership between BNP Paribas and Casino Group.

In an e-commerce market experiencing very strong growth, associated with changing consumer habits and customer expectations with regard to payment methods, the planned transaction will enable FLOA to initiate a new development cycle, capitalizing on BNP Paribas’ expertise and areas of business, particularly in view of European deployment.

The sale price for the acquisition of all outstanding shares in FLOA, for an equity amounting to €184 million at the end of 2020, amounts to €258 million.

The proceeds will be equally divided between Casino Group and Banque Fédérative du Crédit Mutuel, representing €129 million for each company.

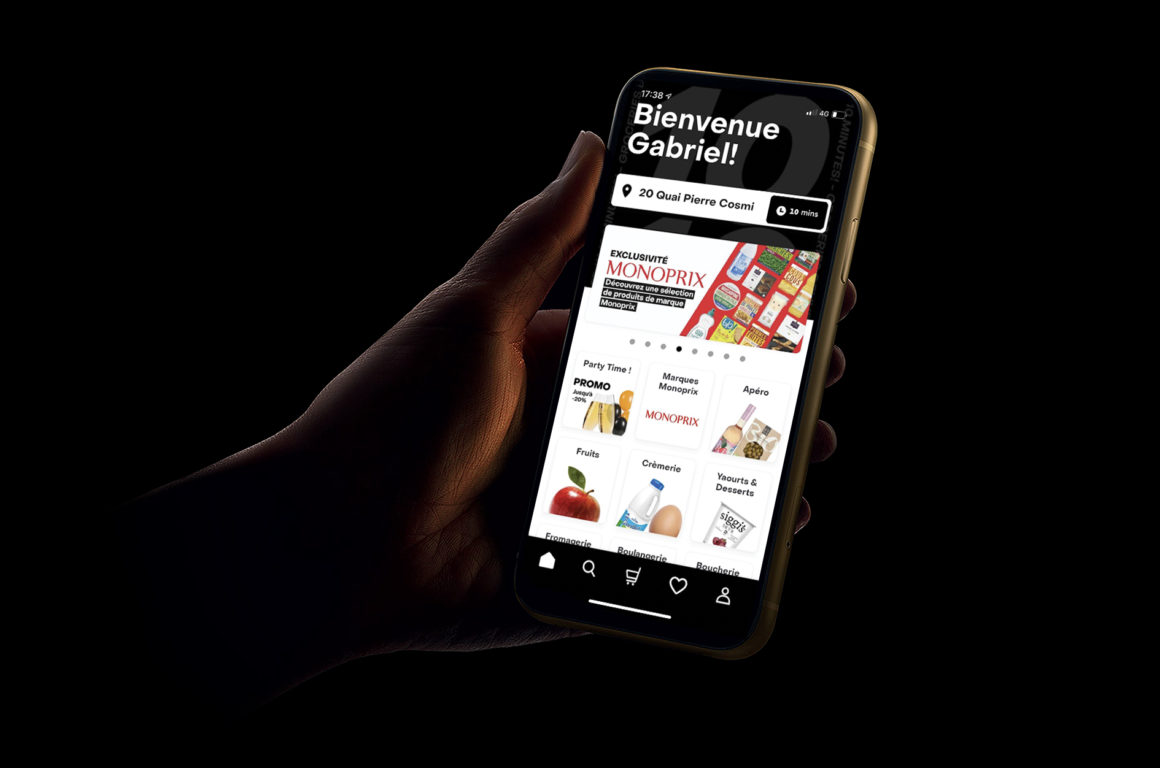

In addition, BNP Paribas will become the exclusive provider and distributor of consumer credit solutions including split payment solutions for Casino Group customers through a commercial partnership to be set up with the Casino Supermarchés, Géant and Cdiscount banners. Cdiscount will continue to operate its bank card payments business with FLOA’s support.

The project will also lead to a collaborative venture between Casino Group and BNP Paribas to develop the FLOA PAY split payment solution. Under the partnership, Casino Group will have a stake in the success of the high-potential payment business.

The planned transaction is subject to consultation with the relevant employee representative

bodies. It is expected to be completed in the next quarters subject to the necessary approvals,

in particular from France’s competition authority and the European Central Bank (ECB)